The 2-Minute Rule for Paypal Business Loan

Wiki Article

Top Guidelines Of Paypal Business Loan

Table of ContentsWhat Does Paypal Business Loan Mean?Paypal Business Loan Fundamentals ExplainedA Biased View of Paypal Business LoanWhat Does Paypal Business Loan Do?The Facts About Paypal Business Loan Uncovered

You'll have numerous alternatives when considering start-up lendings, consisting of SBA lendings, tools funding, lines of credit report, short term loans, and organization credit history cards. The settlements will be based on the amount of the financing, as well as the rate of interest, term, and also security. To qualify, it's typically required to have a credit rating score of 680 or higher.With a business acquisition funding, you'll get anywhere from $5,000 to $5,000,000. One of the finest elements of these financings is that interest rates start as reduced as 5.

These favorable rates indicate you'll conserve a substantial amount of money over the life time of the lending. Obtaining a company acquisition loan can provide a jumpstart to your organization, as getting a franchise business or existing organization is a fantastic way to tip right into a practical service without the backbreaking work of constructing it from scratch.

While the application varies depending on whether you're acquiring a franchise business or existing business, you can intend on loan providers assessing factors such as your credit rating, service tenure, and also profits. You'll require to give documents of the company's efficiency and also assessment, in addition to your very own organization strategy as well as financial estimates.

The Greatest Guide To Paypal Business Loan

There's no issue with your organization carrying financial debt. The question is whether your business can handle its financial debt obligations. To get a grain on your organization financial debt insurance coverage, a loan provider assess your money flow and financial debt settlements.

Lenders also care regarding the state of your service financial debt. What matters is whether the quantity of debt you're bring is appropriate compared to the size of your organization as well as the industry you're functioning in.

Get This Report on Paypal Business Loan

Lenders are much more inspired to deal with you if your organization is trending in the ideal direction, so they'll want to ascertain what your average revenue development will certainly more than time. If your own lands at or above the standard for your market, you're in excellent shape. If you drop listed below the standard, intend on there being some possible obstacles in your pursuit of funding.The right one for your service will certainly depend on when you require the cash and also what you require it for. Here are the 10 most-popular kinds of service fundings.

Best for: Organizations looking to increase. The Small Business Administration guarantees these lendings, which are offered by financial institutions and various other lending institutions.

Prices will certainly rely on the worth of the equipment as well as the toughness of your organization. Pros: You possess the tools as well as develop equity in it. You can get affordable rates if you have strong credit report as well as organization funds. Disadvantages: You may have to develop a deposit. Equipment can become obsoleted a lot more rapidly than the go to the website length of your financing.

this

Paypal Business Loan Can Be Fun For Everyone

Other solutions might be provided, such as consulting and also training. Cons: Smaller car loan quantities. You may need to meet rigorous qualification requirements. Best for: Startups as well as organizations in deprived communities. Companies seeking just a percentage of funding.As we have actually reviewed, there are numerous different kinds of company loansand the ideal one for your service inevitably comes down to a variety of variables. At the end of the day, each type of tiny business finance is made for a various service demand. You'll need to consider your credit, your organization's funds, the size of time you have actually been running, and also your factor for the lending before tightening down your options.

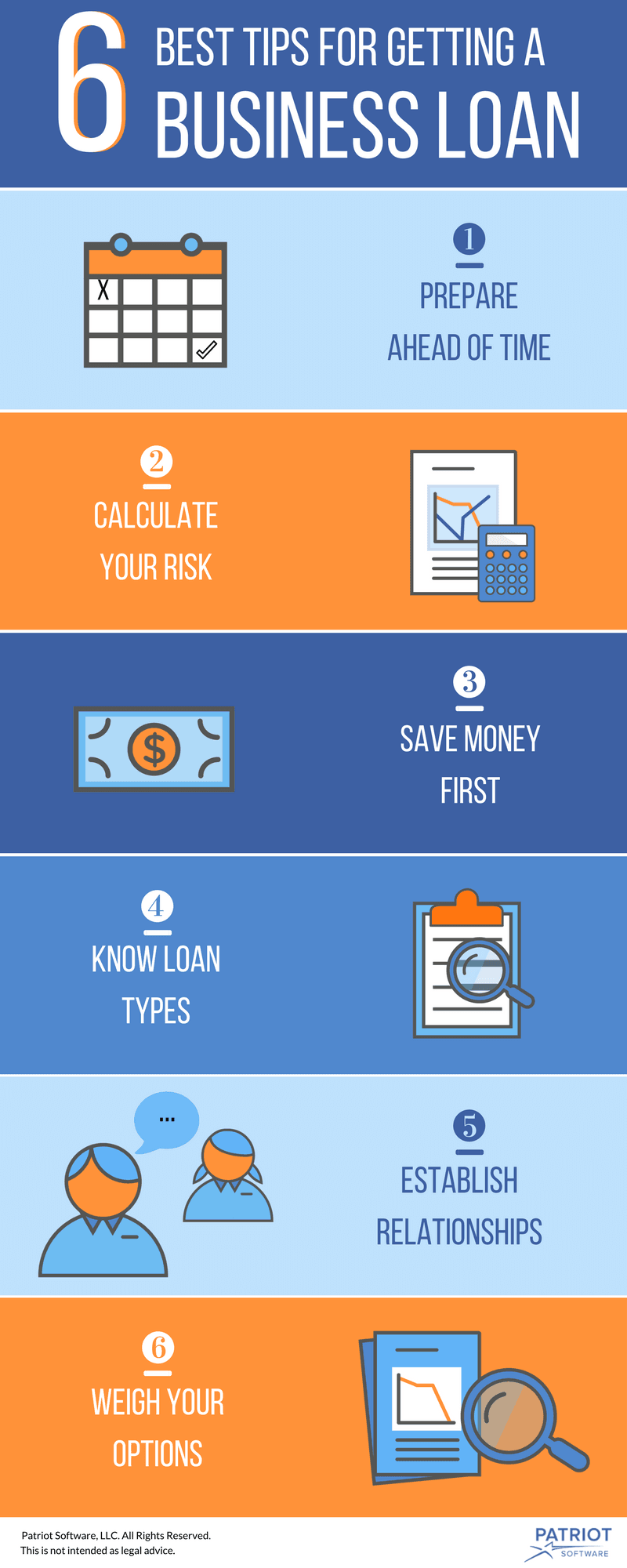

You'll additionally discover a number of alternatives that you can capitalize on if a bank loan is not your ideal financing alternative. There are specific points that every small company proprietor should recognize before heading down the application read more procedure. Here are the 5 primary truths to know: They're all different.

Paypal Business Loan for Dummies

There are a great deal of rip-offs. Know your financial obligation solution protection proportion. Prepare to back your organization. Let's get going: Bank loan are as varied as the small company owners that make an application for them. Not every financing firm operates in the same fashion, and also also within the same financing business, you'll locate various kinds of car loans.Report this wiki page